The US Federal Prompt Payment Act (PPA) protects all tiers of contractors, subcontractors, and suppliers from late payments on federally-funded construction projects. It does this by providing a timeline of when payments will be released to the prime contractor, subcontractors, and suppliers, respectively.

The PPA was originally enacted in 1982 to expedite the payment process from government agencies, who were notoriously slow to pay. There were additional provisions added in 1988, particularly in favor of subcontractors, because not much had changed for them since ‘82.

Table of Contents

While most states have prompt payment laws, the federal Prompt Payment Act applies to any company providing material or labor for a federal construction project. This requirement applies to construction funded by any agency of the federal government or the District of Columbia.

The law protects all levels of contractors, subcontractors, and suppliers. It is effective on all construction projects, including remodels and new construction.

States also have their own prompt payment laws that set deadlines for public and private projects. This article will focus on the federal law only.

Basically, the federal Prompt Payment Act says that, if a payment is late on a government-funded construction project, the hiring party must pay interest on that payment.

All federal contracts have the PPA language in them, and GCs and subcontractors are required to include the language in their contracts with their lower tiers.

In order to qualify under the Prompt Payment Act, the contractor must provide a proper invoice to the government contracting officer.

To be considered “proper,” the payment application must include:

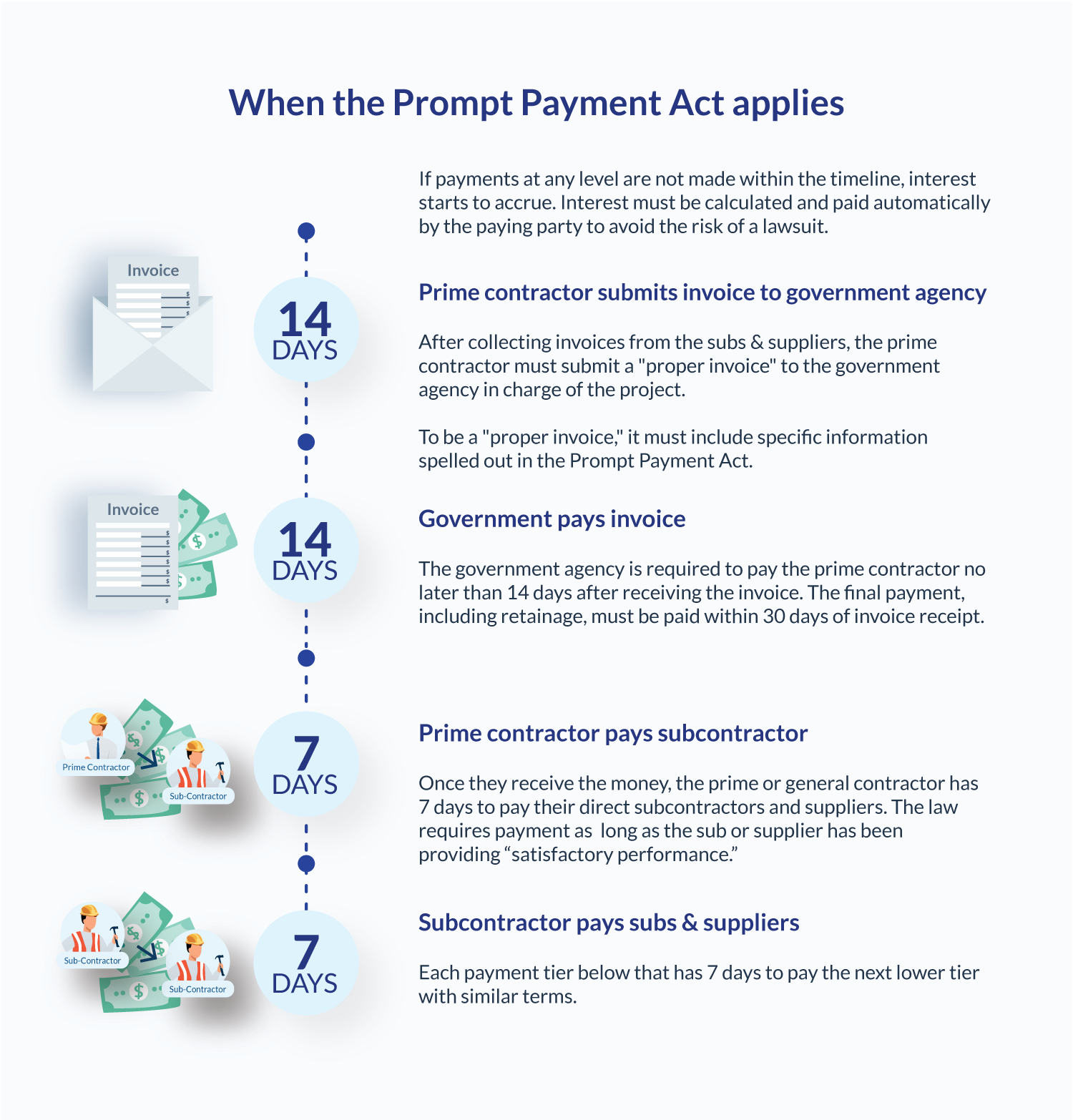

Deadline: 14 days

The federal Prompt Payment Act states that the government agency must pay the prime contractor on a construction project no later than 14 days after receiving an invoice for a progress payment.

The final payment, including retainage, must be paid within 30 days after receiving an invoice.

Deadline: 7 days

Once they receive the money, the prime or general contractor has 7 days to pay their direct subcontractors and suppliers. The law requires payment as long as the sub or supplier has been providing “satisfactory performance.” (Basically, if they’ve been performing up to the standards of their contract.)

Deadline: 7 days

Each payment tier below that has 7 days to pay the next lower tier with similar terms. If payments at any level are not made within the timeline, interest starts to accrue. Interest must be calculated and paid automatically by the paying party to avoid the risk of a lawsuit.

The Congressional Research Service produces this free guide, helpful to subcontractors at any level on a federal project: Legal Protections for Subcontractors on Federal Prime Contracts.

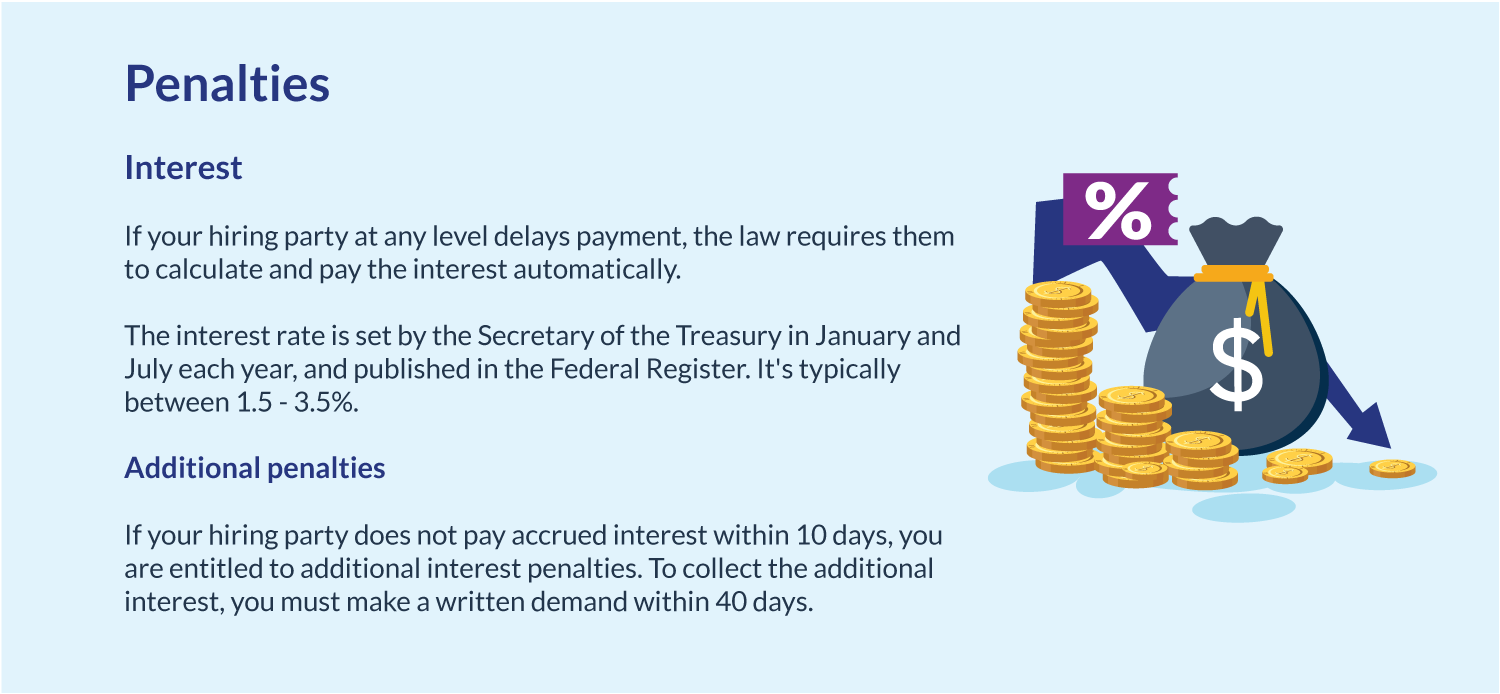

The rate of interest charged for late payments is established by the Secretary of the Treasury, and published in the Federal Register under section 7109(a)(1) and (b) of title 41, which is in effect at the time the agency or contractor accrues the obligation to pay the penalty. If you are on a federally-funded project, make sure you track these rates so you know what you are due or will have to pay if a payment comes late.

You can learn the current interest rate by calling the Department of Treasury’s Financial Management Service (FMS) Prompt Payment help line at 1 (800) 266-9667.

Offending parties should include interest in payments automatically. If you are making a late payment, the law requires that you include a notice that some of the amount being paid is interest due as a result of the failure to abide by PPA timeframes and the rate used for the calculation.

Additional interest penalties will be due to the contractor if the government fails to pay an interest penalty of $1 or more within 10 days following the payment of the invoice amount. The contractor must make a written demand to the payment office in order to enforce an additional interest penalty.

If a party delays a payment beyond the PPA deadline, the law requires the agency or contractor to calculate and pay the interest automatically. If they make a late payment, but fail to pay the accrued interest within 10 days, you are actually entitled to additional penalties. In order to be eligible, the contractor must make a written demand for payment and interest within 40 days.

Confusingly, the law doesn’t state exactly what the additional penalty is. It states simply that it’s a percentage of the interest penalty, determined by the Director of the Office of Management and Budget.

The payment deadline can be longer only if the Request for Proposals (RFP) or bid request specifies more time to inspect the work and determine that it meets the contract requirements.

The law allows the government, contractors, and subcontractors to include a retainage provision in the contract that retains a specific amount from progress payments. However, the party must pay retainage within 30 days of “final acceptance.”

If a prime contractor or subcontractor is not providing “satisfactory performance” of their work, the government agency or prime contractor can withhold a portion of their payment. It is important to note that there must be a good reason for the withholding.

The GC or agency must provide notice of the withholding within 7 days of receipt of invoice. The notice of withholding sent to the GC or sub must include the amount withheld and the reason for withholding. The notice must specify what the GC or sub needs to do to correct the work and obtain payment.

The party withholding payment must release it as soon as practical, but not later than 7 days after “receipt of satisfactory written notification that the identified subcontract performance deficiency has been corrected.” If a party doesn’t pay on time, interest penalties apply according to the PPA schedule.

A GC or sub must also notify the government agency that they are withholding payment to a sub, along with the amount.

A contractor can claim interest and other penalties under the Prompt Payment Act if:

But, wait! Making a prompt payment claim isn’t like making a bond claim or a mechanics lien claim. There isn’t a formal recovery process that helps claimants efficiently recover the interest due under the Prompt Payment Act.

If the party doesn’t make a payment on time, or fails to pay interest on a late payment automatically, the contractor must file a prompt payment claim in civil court.

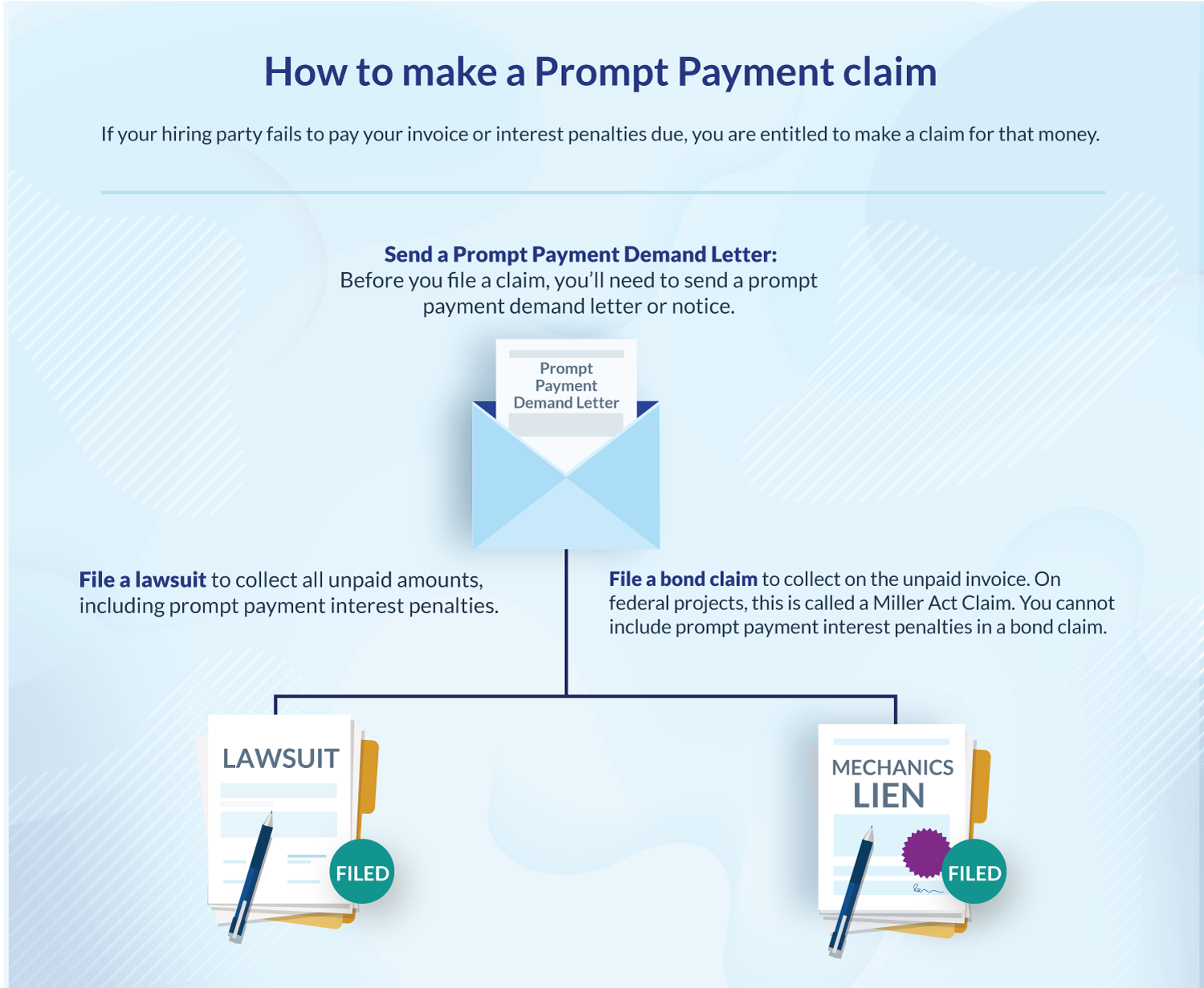

However, filing a formal claim in court may not be necessary to get paid. Sometimes, the late-paying party simply isn’t aware that a payment is late. Before you take your prompt payment claim to court, write a letter demanding payment and interest due.

Before you file a claim, you’ll need to send a prompt payment demand letter or notice. “Demand” sounds harsh; it doesn’t need to be aggressive. The language can be as gentle or forceful as you want it to be. Whether you consider it a request or a demand, send a written letter.

The letter should detail the amount owed, including interest under the Prompt Payment Act. It’s best practice to send such a demand by certified mail. Providing proof that you sent a demand letter can help you support your claim, should you need to file a lawsuit.

Often, sending a demand letter is an effective way to force payment without the need for filing a lawsuit. In this way, it’s similar to a notice of intent to lien.

Levelset offers a template for a demand letter to get you started. You can send this notice as soon as one day after the due date of your payment.

In the event that you don’t receive payment promptly after sending a demand letter, there are other steps you can take. If you want to pursue the interest penalty (and any other penalties), you’ll need to file a claim in civil court. This can be a long and expensive process, so consult with a lawyer to determine the value of your claim and whether it’s worth the effort.

Another way to collect on an unpaid bill is to file a bond claim. On a federal project, this is also called a Miller Act Claim. It is important to note that you cannot file a mechanics lien against federal government property. However, filing a bond claim is similar to a lien and is just as effective at forcing payment.

The federal government has done the best it can to protect contractors and suppliers from slow payments on their projects. But the federal government isn’t the only one: Nearly all states have protection for fast payments on public projects, and over half protect payments on private projects as well.

It is important that you know what level you are on the payment totem pole, so you understand the timeline. You need to know when to expect payment so you can calculate when to send a demand letter, or even file a claim if necessary.